A Smarter Way of Investing

February 13, 2026

In March, we headed to Sydney for the Young Guns Forum, where we connected with other financial planning business owners to share ideas, improve our client experience, and discuss industry-specific challenges.

One of the key takeaways came from Mark Brimble, a member of our Investment Committee, who presented research from Griffith University (2021) titled “The Value of Professional Advice for Consumers in a Crisis.”

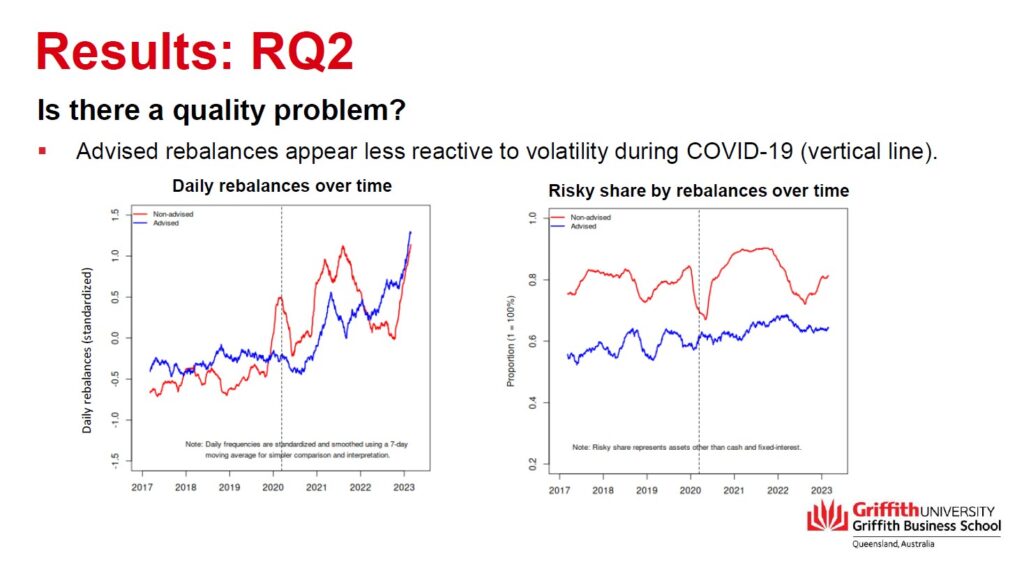

The study highlights how professional financial advice enhances portfolio resilience, particularly during market downturns. It reinforces the importance of focusing not just on raw returns, but on risk-adjusted returns—a measure of an investment’s performance after factoring in the risk taken to achieve it.

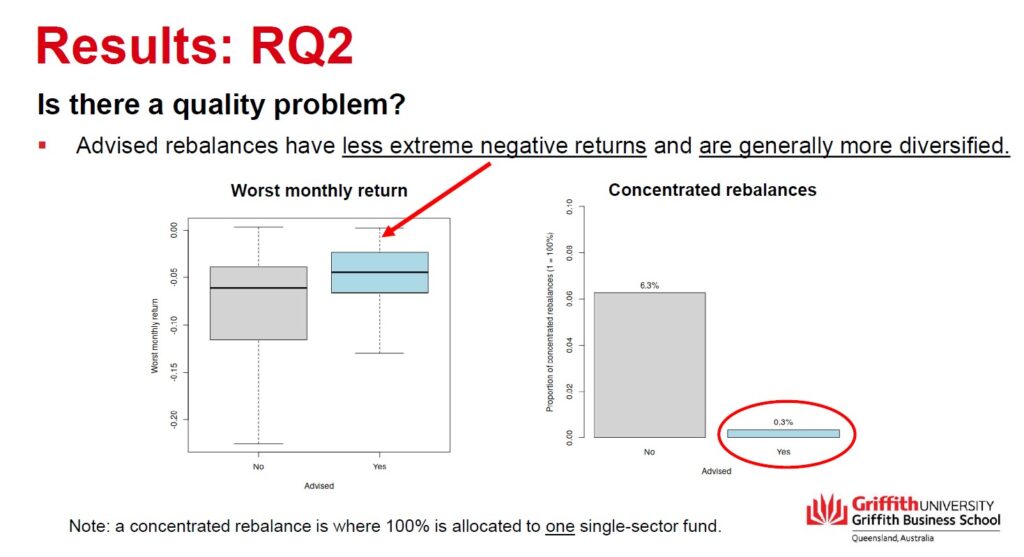

The study found that while advised portfolios may sometimes have lower raw monthly returns, they experience less extreme negative returns, are better diversified, and achieve higher risk-adjusted returns.

One of the key ways we help our clients manage risk is through portfolio rebalancing. This involves periodically adjusting asset allocations to ensure they remain aligned with investment objectives and risk tolerance. Without rebalancing, a portfolio can drift from its intended structure due to varying asset class performances, potentially exposing investors to unintended risks.

How Rebalancing Works:

- Maintaining Asset Allocation: If one asset class outperforms others, it may dominate the portfolio. Rebalancing involves selling some of the overperforming assets and reinvesting in underrepresented ones to restore balance.

- Reducing Risk Exposure: By realigning the portfolio, we can prevent excessive exposure to riskier assets, mitigating the impact of market downturns.

- Enhancing Long-Term Returns: While rebalancing may sometimes involve trimming high-performing assets, it ultimately supports sustainable, long-term wealth creation by keeping the portfolio aligned with risk-adjusted return objectives.

The key takeaway is that successful investing isn’t just about maximizing short-term returns—it’s about building long-term wealth while managing risk effectively. Professional advice plays a crucial role in ensuring investors remain disciplined, avoid emotional decision-making, and stay committed to strategies that optimise risk-adjusted returns.

In short, portfolio rebalancing serves as a safeguard against unnecessary risks, helping investors navigate market fluctuations with confidence.

By prioritising stability and efficiency over sheer performance, we help our clients achieve financial security and long-term success.

If you have any questions or would like to learn more, please feel free to get in touch with us – we’d love to have a chat!

The team at Game Plan Wealth Advisers

The following information is provided as information only and does not constitute financial product advice. It should not be relied on as financial product advice. None of the information provided takes into account your personal objectives, financial situation or needs. You must determine whether the information is appropriate for your particular personal and financial circumstances. For financial product advice that takes account of your particular objectives, financial situation or needs, you should consider seeking financial advice from an Australian financial services licensee before making a financial decision.

Game Plan Wealth Pty Ltd ABN 16 680 049 129, trading as Game Plan Wealth Advisers, is an authorised representative of GPS Wealth Limited ABN 17 005 482 726 holder of Australian financial services licence number 254544 (“GPS”). GPS is owned by Count Limited ABN 111 26 990 832 of GPO Box 1453, Sydney NSW 2001. Count Limited is listed on the Australian Stock Exchange.